Acquire Vs Lease: Comprehending the Benefits And Drawbacks of Living in an Apartment

The decision to purchase or rent out an apartment includes careful consideration of different aspects. Each alternative provides unique benefits and negative aspects that can considerably influence one's economic situation and way of living. Customers typically deal with large upfront prices and ongoing upkeep obligations, while tenants take pleasure in versatility and lower preliminary investments. As individuals evaluate these components, comprehending the subtleties of each choice comes to be crucial. What factors inevitably affect the decision in between these 2 paths?

The Financial Aspects of Acquiring an Apartment

When taking into consideration the acquisition of an apartment, potential purchasers need to carefully evaluate the economic effects involved. The preliminary costs can be considerable, consisting of the deposit, closing costs, and numerous charges associated with inspections and evaluations. Purchasers must additionally factor in recurring costs such as residential or commercial property taxes, home owners' association (HOA) charges, insurance coverage, and upkeep costs.Financing options play a crucial function in the general price of the home. apartments for rent near me. Rates of interest, finance terms, and credit rating can greatly influence regular monthly home loan repayments. In addition, prospective buyers must take into consideration the long-lasting investment worth of the residential or commercial property, as realty can value in time, supplying economic advantages in the future.Ultimately, thorough research study and economic planning are essential for making an informed decision about acquiring an apartment. Purchasers have to consider the prospective returns versus their economic security and personal conditions to guarantee a sound investment

The Financial Effects of Renting Out

The economic ramifications of leasing include month-to-month rental costs, which can vary based on location and market conditions. Occupants also birth much less duty for maintenance costs, as these generally fall on the proprietor. Nonetheless, the absence of long-lasting monetary commitment can impact one's capacity to construct equity with time.

Monthly Rental Fee Expenses

Many individuals are attracted to the versatility that renting out deals, the economic ramifications of monthly lease costs can substantially impact their budget plans. Rental fee typically stands for a considerable section of a lessee's monthly expenses, typically ranging from 25% to 50% of their revenue. This irregularity depends upon elements such as place, residential or commercial property dimension, and services. Additionally, rent settlements are needed regularly, making it crucial for occupants to preserve a stable revenue to prevent financial pressure. Unlike home mortgage repayments, which build equity over time, lease payments do not add to possession accumulation. Consequently, potential renters have to meticulously examine their financial situations and think about how month-to-month lease prices will suit their overall spending plan before dedicating to a rental arrangement.

Maintenance Costs Duty

While renters take pleasure in the advantage of not needing to stress over several maintenance tasks, they may still face substantial economic implications relating to obligation for upkeep. Normally, proprietors are accountable for significant repair services and upkeep, which reduces some prices for occupants. Tenants could be accountable for small fixings, such as replacing light bulbs or taking care of a dripping faucet. Additionally, unforeseen costs can occur from problems like plumbing or electrical failings, which might lead to enhanced economic worry if not covered by the lease contract. Occupants must likewise take into consideration the possibility for rental fee enhances to cover upkeep expenses. Subsequently, while upkeep responsibilities are largely shifted to property owners, renters should remain knowledgeable about their responsibilities and feasible expenses that can occur during their lease term.

Long-term Financial Dedication

Financial stability usually pivots on the decision in between renting out and getting an apartment, specifically when thinking about the long-term dedications linked with each choice. Leasing may appear monetarily versatile, allowing people to relocate quickly and prevent large down payments. However, it can bring about continuous regular monthly expenses without constructing equity. Renters are subject to annual rent boosts, which can strain budgets gradually - luxury apartments for rent glen carbon il. Additionally, the lack of possession suggests that rental settlements do not add to lasting wide range accumulation. On the other hand, acquiring an apartment generally involves a considerable upfront financial investment yet offers the potential for property worth gratitude. Eventually, the choice in between renting and getting needs mindful evaluation of one's financial goals and long-term stability

Stability vs. Versatility: Which Is Right for You?

When considering apartment living, people typically consider the advantages of security versus the demand for adaptability. Lasting commitments, such as purchasing a residential or commercial property, can offer security however may limit mobility and adaptability. Conversely, renting enables better flexibility to move, providing to those whose circumstances might change frequently.

Lasting Commitment

Selecting in between buying and leasing an apartment typically rests on the person's desire for security versus their demand for adaptability. A long-lasting commitment to purchasing typically shows an intent to settle in one area, cultivating a sense of durability. Homeownership typically features monetary advantages, such as equity building and potential appreciation in building worth, adding to long-lasting security. Alternatively, renting out permits higher flexibility, making it possible for individuals to change their living scenario based on life circumstances or preferences. Tenants may prefer this choice during changing durations, such as work adjustments or personal growth. Ultimately, the choice between a lasting dedication to ownership or the adaptability of leasing shows individual priorities and future desires, significantly affecting one's way of living and monetary planning.

Movement and Versatility

The decision to acquire or lease an apartment considerably influences an individual's wheelchair and adaptability in life. Homeownership generally uses security but can restrict adaptability due to the long-lasting economic commitment and initiative needed to sell a residential property. On the other hand, leasing enables better movement, enabling individuals to relocate easily for job chances or way of living changes without the problem of offering a home. This flexibility can be especially beneficial for those in shifting phases of life, such as trainees or young experts. While renting out can bring about an absence of durability, it offers the freedom to check out different communities and cities. Inevitably, the selection between purchasing and renting joints on individual top priorities-- security versus the demand for adaptability in an ever-changing world.

Upkeep Obligations: Homeownership vs. Renting out

While homeownership usually brings the allure of freedom, it likewise features a significant worry of maintenance obligations that tenants typically stay clear of. Home owners should handle fixings, landscape design, and regular maintenance, which can be both time-consuming and pricey. This consists of dealing with pipes issues, roofing system repair services, and home appliance malfunctions, every one of which can add stress to the homeowner's life.In contrast, tenants typically gain from a much more hands-off approach to upkeep. Home supervisors or landlords handle repairs and upkeep tasks, permitting renters to concentrate on their living experience as opposed to building treatment. This division of obligations can be especially appealing for those that focus on adaptability and simpleness in their living arrangements.Ultimately, the choice between purchasing and renting depend upon one's readiness to handle upkeep responsibilities, with homeownership demanding a commitment that many occupants might favor to avoid.

Financial Investment Prospective: Getting an Apartment

Buying an apartment can supply significant monetary benefits in time. As residential property values generally appreciate, house owners might see their investment expand substantially, generating a rewarding return when marketing. Furthermore, having an apartment gives a bush versus inflation, as mortgage payments stay steady while rental rates might get more info boost. The possibility for rental income includes an additional layer of monetary benefit; proprietors can rent their units, creating passive earnings that can counter mortgage expenses and add to total wide range accumulation.Furthermore, tax obligation advantages typically accompany home ownership, consisting of reductions for home loan interest and residential property tax obligations. These financial motivations improve the good looks of purchasing an apartment as a financial investment. Nonetheless, prospective investors need to likewise consider market fluctuations and linked possession expenses, such as maintenance and organization costs. A complete analysis of these elements can help figure out if purchasing an apartment aligns with a person's financial goals and take the chance of resistance.

Way Of Life Considerations: Features and Location

Choosing the right house entails mindful factor to consider of lifestyle factors, particularly amenities and place. Numerous individuals focus on amenities that improve their living experience, such as health and fitness centers, pools, or public areas. These facilities can significantly influence daily regimens and social communications, making home life much more enjoyable.Location is similarly essential; closeness to work, institutions, purchasing, and public transportation influences ease and overall lifestyle. Urban residents might prefer apartment or condos in busy communities, while those looking for tranquility might prefer suv settings. Furthermore, safety and security and area vibe play crucial duties in establishing a suitable location.Ultimately, the right combination of amenities and area can develop a harmonious living setting that lines up with personal choices and way of living demands. Each individual's priorities will certainly differ, making it essential to examine these variables thoroughly before making a choice about getting or leasing an apartment.

Lasting vs. Short-term Living Plans

The decision between lasting and temporary living setups significantly impacts one's apartment or condo experience. Long-lasting services typically provide security, enabling occupants to establish origins in an area. This stability commonly brings about a much deeper understanding of regional facilities, social links, and individual convenience. In addition, lasting leases might provide lower monthly rates contrasted to temporary alternatives, which are typically a lot more pricey due to flexibility.Conversely, short-term plans interest those seeking mobility or momentary housing remedies. This adaptability can be helpful for individuals checking out brand-new cities, traveling for work, or researching. However, short-term services usually do not have the sense of durability and may include frequent relocations.Ultimately, the choice in between long-lasting and temporary living depends upon specific scenarios, concerns, and way of life preferences. Careful factor to consider of these elements can bring about a more enjoyable house experience, customized to one's certain requirements.

Often Asked Concerns

Exactly How Do Property Tax Obligations Impact House Possession Expenses?

Residential or commercial property taxes significantly affect the general costs of house possession. Greater taxes can raise monthly costs, affecting budgeting. In addition, rising and fall tax obligation rates may affect home worths, making ownership less economically helpful in specific markets.

What Are Common Lease Lengths for Rental Homes?

Normal lease sizes for rental homes typically vary from six months to one year. Some proprietors may supply month-to-month choices, while longer leases of 2 years or more can also be negotiated depending upon renter needs.

Can I Bargain My Rental Fee Rate With Landlords?

Bargaining rental fee costs with property owners is frequently possible, depending upon market conditions and the landlord's adaptability. Prospective renters should prepare to provide their instance, highlighting factors for settlement to boost their opportunities of success.

What Takes place if I Need to Damage a Rental Lease?

When a tenant needs to break a rental lease, they may incur fines, forfeit their protection deposit, or face legal effects. It's vital to evaluate the lease terms and interact with the property manager promptly.

Exist Hidden Fees When Purchasing an Apartment?

When buying an apartment, possible hidden costs may include shutting expenses, upkeep costs, building taxes, and home owners organization dues. Customers need to thoroughly evaluate all economic facets to prevent unexpected expenditures post-purchase.

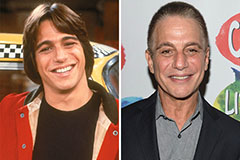

Tony Danza Then & Now!

Tony Danza Then & Now! Ben Savage Then & Now!

Ben Savage Then & Now! Dylan and Cole Sprouse Then & Now!

Dylan and Cole Sprouse Then & Now! Mackenzie Rosman Then & Now!

Mackenzie Rosman Then & Now! Michael C. Maronna Then & Now!

Michael C. Maronna Then & Now!